This alert is relevant for you if you are involved in the transportation, mining, agriculture or any other relevant business that uses fuel.

What are fuel tax credits?

As you may be aware, businesses conducting certain activities may claim fuel tax credits (basically a refund of part of the excise duty paid when they purchased the fuel).

Broadly, the amount of fuel tax credits allowed depends on:

- The type of fuel used in the business1;

- The type of business activity for which the fuel is used; and

- When the fuel was acquired for use in the business.

Are you claiming the maximum possible fuel tax credits refund?

Different rate depending on how the fuel is used in your business.

Since the amount of fuel tax credits a business may claim depends on these different factors, there is a risk that businesses may claim fuel tax credits at incorrect rates.

For example, if a business acquired petrol after 2 February 2015, the fuel tax credits rate will differ depending on the type of activity the business is engaged in.

|

How the petrol is used in the business |

Amount of fuel tax credit |

|

Used in heavy vehicles2 for travelling on public roads |

12.76c per litre |

|

To power auxiliary equipment (e.g. refrigeration units or concrete mixing barrels) of heavy vehicles travelling on public roads |

38.9c per litre |

|

Other business uses (e.g. used in machinery, plant and equipment) |

38.9 cents per litre |

This means that for a heavy haulage vehicle that does 70,000 kilometres a year at 57 litres per 100km, you would be entitled to $5,0913 worth of fuel tax credits a year for this vehicle. If you have 10 of these trucks across your fleet, your claim will add up to $50,912.

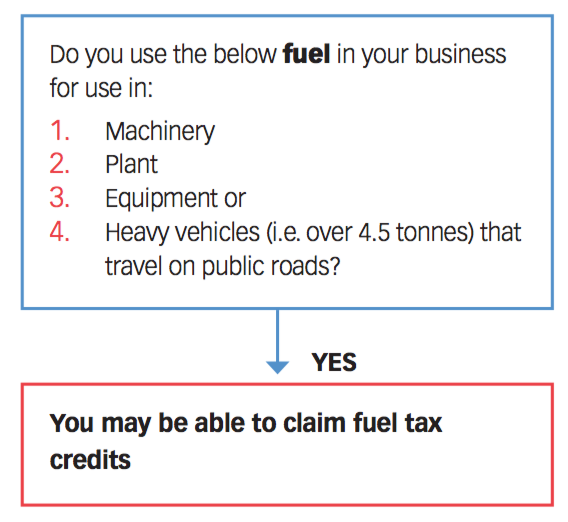

Can you claim fuel tax credits?

Eligible Fuel

- Diesel, Petrol

- Gaseous fuels (LPG, CNG, LNG)

- Kerosene, Heating oil

- Toluene, Fuel oil, Industrial solvents

Not Eligible Fuel

- Aviation fuel

- Some alternative fuels (ethanol, biodiesel)

- Fuels used in light vehicles travelling on public roads

- Fuel acquired but not used (because it was lost, stolen or otherwise not used)

How can Nexia help you maximise your fuel tax credits claim?

We can help you with your fuel tax credits claim

As you can see from the table above, it is very important to correctly classify your business activity so that you can claim the correct amount of fuel tax credit.

Nexia has the necessary skills and experience to help you with all your claims for fuel tax credits and to ensure that you claim the maximum amount legally possible.

As such, we can help you to identify whether the fuel you use in your business is eligible for fuel tax credits, determine the amount available and assist you in making a claim for fuel tax credits. For further information, please contact your Nexia Advisor.

1 - For example liquid fuels (e.g. petrol or diesel), gaseous fuels (e.g. LPG gas) or blended fuels (e.g. mixtures containing biodiesel or ethanol). 2- Vehicles with gross vehicle mass (GVM) of more than 4.5 tonnes. 3- (70,000km / 100km x 57l) x 12.76 c/l = $5,091.