12 DECEMBER 2018

No deduction if no withholding from 1 July 2019

As mentioned in a previous Top Tax Tips , from 1 July 2019, employers can only claim a tax deduction for payments made to workers (i.e. employees or contractors) if the employer has complied with the specific withholding and reporting obligations applicable to a particular payment.

Although these new rules only apply from 1 July 2019, employers might take this opportunity to check their compliance with the PAYG withholding tax rules applicable to payments of salary, wages, commissions, bonuses or allowances to an employee, payments of directors’ fees and payments to contractors especially if they do not have an ABN.

Your Nexia representative would be pleased to review what systems are in place to ensure compliance with the ever-changing income tax (PAYG), fringe benefits tax and superannuation laws. If necessary, we can redesign systems to generate efficiencies and cost savings in complying with those laws. This will hold any business in good stead in the event of a review by the ATO and will reduce exposure to ATO penalties.

31 OCTOBER 2018

Proposed changes to Division 7A from 1 July 2019

Division 7A is an anti-avoidance measure that aims to prevent the tax-free distribution of profits from private companies to shareholders or their associates (e.g. relatives of individual shareholders or entities within the same family group of company shareholders).

Specifically, Division 7A targets the following types of transactions often used to try and extract money from companies through:

- loans from a private company to shareholders or associates;

- payments from a private company to shareholders or associates; or

- the forgiveness of debts owed to a private company by shareholders or associates.

Division 7A will deem such distributions to be unfranked dividends (i.e. a shareholder who receives an unfranked dividend is not entitled to receive franking credits – which in effect means that a shareholder in receipt of such a dividend will pay more tax).

Currently, one of the main strategies to either eliminate or minimise the risk of Division 7A from applying is to convert such loans to either a complying:

- 7-year loan (for unsecured loans); or

- 25-year loan (for secured loans).

However, from 1 July 2019, the Government proposes to replace these 2 types of loan arrangements (i.e. 7 or 25 years) with a single 10-year term loan. To ease the conversion to a 10-year loan from 1 July 2019, transitional rules will apply for 7 or 25 year loans that are on complying terms as at 30 June 2019.

If you believe that you may be confronted with a Division 7A problem, or would like us to determine your Division 7A risk profile, please let us know.

We would be happy to perform a financial health check on how you have handled your Division 7A exposure in the past as well as work together with you to implement a workable Division 7A strategy for the future.

17 OCTOBER 2018

Proposed denial of deductions if no withholding

Currently, employers and other entities engaging contractors can generally deduct certain kinds of payments (e.g. salary, wages, commissions, bonuses, director’s fees or payments for the supply of services where the contractor has not quoted an ABN) even if the paying entities have not complied with the associated withholding obligations applicable to the making of such payments (e.g. PAYG withholding on the payment of salaries to employees).

It is proposed that from 1 July 2019, paying entities will no longer be entitled to a tax deduction if they failed to withhold amounts under the PAYG system. For example, an employer paying a salary to an employee would not be entitled to a deduction if PAYG was not withheld and notified to the ATO.

However, deductions would still be allowed if an incorrect amount has been withheld and reported to the ATO.

There is also a partial exception from this withholding rule in circumstances of employee/contractor misclassification. For example, if an employer genuinely believed that an employee was actually acting as a contractor – and because the alleged contractor quoted an ABN, the employer would not have been required to withhold (pursuant to the no ABN withholding rule), and therefore would have been entitled to a deduction for the payment.

If a later year ATO audit reveals that the alleged contractor was in fact an employee, there would be no need to amend tax returns for the previous deductions claimed. However, penalties will be imposed for failure to withhold in the past and going forward, the employer will have to withhold PAYG on salary payments made to the “now newly classified employee”.

We will keep you updated on any new developments with this proposed “denial of deductions if no withholding” measure.

26 SEPTEMBER 2018

Now more difficult to qualify for small business CGT concessions when selling shares or interests

When selling a business, it is always important to determine whether or not a seller can qualify for the small business CGT concessions to either exempt, reduce or defer a capital gain made on the sale.

When examining the small business CGT provisions to determine if a taxpayer would qualify for these concessions, there is an obstacle course of conditions that must be navigated, but if applied correctly, the concessions can deliver excellent results on the sale of a business. The CGT concessions are the:

- 15-year exemption (i.e. exempt capital gain provided the business was owned for at least 15 years);

- retirement exemption (i.e. can contribute $500,000 to superannuation if under 55 years of age);

- 50% active asset reduction (i.e. automatic 50% discount); and/or

- replacement asset rollover (i.e. defer capital gain for 2 years automatically)

For a taxpayer to be entitled to the concessions, the taxpayer must meet certain basic conditions (e.g. a taxpayer must have a total turnover of less than $2 million and be carrying on a business in the current year or have total net assets of $6 million or less just before the CGT event). In addition to meeting the basic conditions above and depending on which concession the taxpayer wants to claim, concession specific conditions will also have to be met.

If a taxpayer is selling business assets, the enquiry stops here – however, if the taxpayer is selling shares or an interest in either a company or a trust, additional conditions will have to be met:

- if an individual holds the shares/interests in a company/trust (i.e. object entity) that are to be sold, the individual taxpayer or his/her spouse must be a CGT concession stakeholder (i.e. individual or spouse must hold 20% or more of the voting and distributions rights in the company or trust); or

- if a company or trust holds the shares/interests that are sold, all CGT concession stakeholders in the object entity must hold at least 90% of the shares/interests in the company/trust selling the shares/interests.

Recently, a Bill passed the Senate that will make it even more difficult (i.e. impose more conditions) on taxpayers to qualify for small business CGT concessions if shares in a company or interests in a trust are sold on or after 8 February 2018. Treasury believes that these changes will stop schemes exploiting access to the small business CGT concessions (i.e. avoid concessions from being inappropriately applied when shares or interests in large businesses are sold).

The Bill imposes three additional conditions that have to be met when selling shares or an interest in companies or trusts (so in total there is now 4 conditions that will have to be satisfied when selling shares or interests).

According to these additional changes the concessions will only be available if (in addition to the conditions mentioned above):

- the taxpayer (i.e. the entity selling the share/interest) either satisfies the $6 million net asset value test or carries on a business just before the taxpayer sold the shares or interests;

- the object entity (i.e. the company or trust in which shares or interests are sold) is either a CGT small business entity (i.e. turnover less than $2 million and carrying on a business) or satisfies the $6 million net asset value test in the year of sale; and

- shares or interests in the object entity satisfy a modified active asset test.

As you can no doubt see, determining whether you can qualify for small business CGT concessions when you sell your business (either selling the business assets or the shares or an interest in a company or trust) is no simple task.

Therefore, please speak to your Nexia adviser so that we can perform proper due diligence and help guide you through this process.

19 SEPTEMBER 2018

Raft of tax concessions available for entities with turnover of less than $10 million

Small business entities (e.g. companies with a total turnover of less than $10 million) will qualify for the following concessions in the year ending 30 June 2019:

- $20,000 instant asset write-off (i.e. an immediate write-off for depreciable assets costing less than $20,000);

- Access to the small business depreciation pool (i.e. accelerated depreciation rates of 15% or 30%) for depreciable assets costing $20,000 or more;

- Simplified trading stock roles (i.e. not required to do a stocktake if there are no significant variations in stock levels in a year); and

- Shorter amendment period for tax returns (i.e. 2 years instead of 4 years).

Furthermore, such businesses – when lodging their business activity statements (BAS) – will:

- only have to inform the ATO about GST on purchases and total sales (instead of filling in a number of other labels that may not be relevant to the business);

- be able to electronically lodge a nil activity statement with just one click (i.e. without having to fill in each label with a zero); and

- be able to sign the declaration by merely clicking a checkbox (i.e. without having to use AUSkey or myGov credentials).

Note however that access to the small business CGT concessions remain limited to entities with either a total turnover of less than $2 million (i.e. this test is not increased to the $10 million turnover threshold) or total net asset value of less than $6 million.

Furthermore, companies with a turnover of less than $50 million for the 2019 income tax year will be taxed at a rate of 27.5% provided 80% or less of the company’s total assessable income is derived from passive activities (e.g. the receipt of interest, dividends or rent).

Please contact us if your business has a turnover of less than $10 million so that we can discuss in more detail how your business may benefit.

29 AUGUST 2018

Keep your wits about you: lowering of company tax rates and imputation

Recently, a Bill passed the Senate that changes the way company profits are taxed (and dividends are franked) from 1 July 2017 onwards.

The new methodology for determining the way company profits will be taxed is set out below.

- For 2018, companies with a turnover of less than $25 million and deriving 80% or less of total income from passive activities will be subject to company tax at a rate of 27.5% (i.e. company tax will only be 30% if turnover is $25 million or more or if the company derives more than 80% of total income from passive activities in 2018); and

- For 2019, companies with a turnover of less than $50 million and deriving 80% or less of total income from passive activities will be subject to company tax at a rate of 27.5% (i.e. company tax will only be 30% if turnover is $50 million or more or if the company derives more than 80% of total income from passive activities in 2019).

From 2018 onwards, the rate at which dividends can be franked will depend on the company’s turnover of the previous year as well as whether the majority of the company’s income was passive in the previous year:

- 2018 dividend will be franked at 27.5% if the company’s turnover for 2017 was less than the 2018 benchmark ($25 million for 2018) and the company derived 80% or less of total income from passive activities in 2017 (or if the company did not exist in 2017);

- A 2018 dividend will be franked at 30% if the company’s total turnover for 2017 was equal to or more than the 2018 benchmark ($25 million for 2018) or the company derived more than 80% of total income from passive activities in 2017.

The rate at which 2019 dividends will be franked will also be determined by applying the same methodology as mentioned above (i.e. compare the company’s turnover in 2018 to the 2019 benchmark of $50 million and determine the amount of passive income of the company in 2018).

Because company profits may be taxed at different rates from the rate at which these dividends are franked, the disparate tax treatment can lead to either:

- Over-franking of dividends (i.e. if company profits are taxed at 27.5% but franking is done at a rate of 30%) – in which case certain actions need to be undertaken to avoid the imposition of franking deficit tax; or

- Under-franking of dividends (i.e. if company profits are taxed at 30% but franking is done at only 27.5%) – in which case franking credits may become trapped and may not be usable.

These changes are extremely complex, and therefore we would recommend that you speak to your Nexia adviser for assistance if you are operating in a corporate structure.

We can assist you to work out at which rate company profits should be taxed or dividends be franked as well as advise what to do if company profits or dividends were taxed or franked at wrong rates in previous years.

1 AUGUST 2018

Revenue and capital distinction in property development transactions

When landowners (e.g. back-yard developers or established property developers) enter into an arrangement to develop and sell land, the tax law requires the taxpayer to determine whether the ultimate sale will amount to a “mere realisation” of the land, a disposal of the land in the course of a business or as part of a profit making undertaking or plan.

Gains made pursuant to a “mere realisation” transaction will be subject to the more concessionary capital gains tax (CGT) regime (e.g. 50% CGT general discount, main residence exemption and exemption for gains on pre-CGT assets).

In contrast, proceeds on “non-mere realisation” transactions – such as the disposal of land in the course of carrying on a business (e.g. an established property developer) or as part of a profit making undertaking (e.g. back-yard developers may fall into this category) will be taxed on revenue account. Proceeds taxed on revenue account will not qualify for any CGT concessions - however, losses and expenses relating to the property development may be tax deductible).

Determining whether gains on the sale of a property will qualify for the concessional CGT regime or be taxed on revenue account may not be a simple exercise. Don’t be fooled by firms promising one-page tick the box or checklist solutions to such tax problems. The application of the tax law depends on a range of commercial and private factors all of which must be carefully weighed to determine the correct tax outcome.

Detailed consideration must be given to a variety of factors (non-exhaustive list) such as:

- the length of time the land was held and the type of activities undertaken on the land prior to development;

- the purpose for which the land was originally acquired (e.g. for private, recreational, investment or development purposes);

- the location of the land (e.g. near the city fringe) and whether and by whom the land has been rezoned or subdivided;

- whether finance has been obtained to complete the development;

- the development activities of the landowner or have those activities been contracted to a project manager;

- whether the landowner sells the developed property or engages a real estate agent to do so;

- whether the landowner has an ABN and is registered for GST as an enterprise engaged in property development; and

- whether the landowner has a history of property development (e.g. scope, scale duration and degree of property development);

If you have recently sold a property or are thinking of selling a property, please speak to your Nexia advisor so that we can advise you on potential tax consequences as well as how to structure the development and/or sale.

Nexia has significant experience in the property and construction industry and have a dedicated team that can assist you. Please click here to see details on our expertise in the property and construction industry.

1 AUGUST 2018

Building and construction businesses: taxable payment reporting

Taxpayers operating in the building and construction industry must lodge with the ATO by 28 August 2018 their Taxable payments annual report, detailing the total payments made to contractors in 2018.

Through the use of data matching, the information in such reports will enable the ATO to detect contractors who have either not lodged their tax return or have not reported all of their income in their BASs and income tax returns.

Penalties may apply if such reports are not lodged by the due date.

Please contact your Nexia adviser so that we can help you complete and lodge your report on time.

18 JULY 2018

Penalty relief for small businesses from 1 July 2018

The ATO can impose fixed administrative penalties on taxpayers that make false or misleading statements on their tax returns (e.g. if they claim excessive deductions to which they are not entitled or do not declare all income they have earned) that may result in a shortfall amount (i.e. the difference between the correct tax liability and the liability worked out using the wrong information).

- The amount of the penalty is fixed depending on the amount of “culpability” the taxpayer exhibited when filling in the tax return:

- 25% of the shortfall amount for taxpayers failing to take reasonable care (e.g. did not act like a reasonable person when completing a tax return);

- 50% of the shortfall amount for taxpayers acting recklessly (e.g. suspected that there would be real risk of a shortfall amount arising in a tax return but disregarded this risk); or

- 75% of the shortfall amount for taxpayers acting with intentional disregard of the law (e.g. fully aware of the clear tax obligation but disregarded the obligation)

However, for ATO audits after 1 July 2018, no penalty will be imposed if certain individuals or entities with a turnover of less than $10 million (e.g. small businesses, SMSFs, strata title bodies, not-for-profits or co-operatives) made inadvertent errors when completing their tax returns and activity statements because they did not take reasonable care or took a position that was not reasonably arguable.

Because such penalty relief will only be available once every 3 years, penalty relief will not be available if, in the last 3 years, the taxpayer:

- had penalty relief applied;

- was penalised for reckless or intentional disregard of the law;

- evaded tax or committed fraud or was involved with another entity that evaded tax; or

- engaged in Phoenix activity.

Furthermore, penalty relief will not be available for mistakes made in FBT returns or mistakes regarding the superannuation guarantee.

Please contact us if you have been subject to a penalty so that we can assist you in dealing with the ATO. We may be able to have your penalty remitted in full or partly depending on your circumstances (e.g. your compliance history and whether tax was deferred or avoided).

11 JULY 2018

Remember to account for trading stock you use for private purposes

Proprietors of businesses that have trading stock must account for trading stock that is consumed or taken for personal use. For example, the proprietor of a supermarket may take food from the supermarket’s shelves for consumption at home. The market value of the removed trading stock must be included in the assessable income of the entity that is operating the supermarket.

Because keeping track of the value of trading stock used for private purposes over the course of the year may be difficult, the ATO publishes industry–specific guidelines each year that sets out what is regarded as a reasonable estimate of the value of such “withdrawals” from trading stock in that particular year.

Please contact us if you have a business from which trading stock is removed for private purposes (e.g. such as a bakery, butcher, restaurant, caterer, delicatessen, greengrocer, takeaway food shop or convenience store) to ensure that private consumption of trading stock items is correctly recorded on relevant tax returns.

23 MAY 2018

Raft of tax concessions available for entities with turnover < $10 million

For the current 2018 income tax year, the small business entity threshold is $10 million (for the 2016 income tax year the small business entity threshold was only $2 million).

Therefore, such small business entities (e.g. companies with a total turnover of less than $10 million) will qualify for the following concessions in the 2018 income tax year:

- $20,000 instant asset write-off (i.e. an immediate write-off for depreciable assets costing less than $20,000);

- Access to the small business depreciation pool (i.e. accelerated depreciation rates of 15% or 30%) for depreciable assets costing $20,000 or more;

- Simplified trading stock rules (i.e. not required to do a stocktake if there are no significant variations in stock levels in a year); and

- Shorter amendment period for tax returns (i.e. 2 years instead of 4 years).

Furthermore, such businesses – when lodging their business activity statements (BAS) – will:

- only have to inform the ATO about GST on purchases and total sales (instead of filling in a number of other labels that may not be relevant to the business);

- be able to electronically lodge a nil activity statement with just one click (i.e. without having to fill in each label with a zero); and

- be able to sign the declaration by merely clicking a checkbox (i.e. without having to use AUSkey or myGov credentials).

Note however that access to the small business CGT concessions remain limited to entities with either a total turnover of less than $2 million (i.e. this test is not increased to the $10 million turnover threshold) or total net asset value of less than $6 million.

Furthermore, companies with a turnover of less than $25 million for the 2018 income tax year will be taxed at a rate of 27.5%.

The increase in the small business entity threshold to $10 million offers tremendous opportunities for businesses – please contact us if your business has a turnover of less than $10 million so that we can discuss in more detail how your business may benefit.

23 MAY 2018

Make your trust resolutions before 30 June

Trustees of discretionary trusts are reminded to make trust resolutions (i.e. decide how to distribute the income of the trust to the beneficiaries) before 30 June 2018 (or an earlier date if the trust specifies such an earlier date).

Failure to make such a trustee resolution may lead to a trustee assessment at the top marginal tax rate on all of the trust’s net income (if the trust deed does not contain a default/balance beneficiary clause).

Due to the complexities of the tax laws dealing with trusts, please speak to your Nexia Adviser about your trust’s 2018 resolution and potential strategies when dealing with trusts.

9 MAY 2018

Let us help you meet your motor vehicle tax obligations

Businesses should ensure they adequately meet their motor vehicle tax obligations (e.g. GST, FBT, luxury car tax, fuel schemes and income tax) because the ATO is embarking on a data matching program in conjunction with the different State and Territory motor vehicle registry authorities.

Under this ATO action, records of motor vehicles with a purchase price / market value of $10,000 or more in respect of the 2017, 2018 and 2019 income tax years will be scrutinised to identify and address taxpayers buying and selling motor vehicles who may not be meeting their obligations to register and lodge income tax returns or business activity statements. The ATO will also be ensuring that there is correct reporting of income and deductions and GST input tax credits are claimed correctly.

People claiming tax deductions for depreciation of motor vehicles should also maintain a log book for a continuous period of 12 weeks and record all kilometres travelled for business/income producing purposes.From the log book data, the business/income producing percentage is applied to total motor vehicle operating costs (e.g. depreciation, fuel, registration, insurance and servicing/repair costs) to calculate the correct deduction to be claimed.

We can assist you to maintain adequate documentation to assist with all your motor vehicle tax obligations.

24 APRIL 2018

What to do when employing a person on a holiday working visa

From 1 January 2017, employees on working holiday visas (e.g. Subclass 417 or 462 visas) are taxed at a flat rate of 15% on earnings up to $37,000 with ordinary marginal rates of tax applying after $37,000.

There is no $18,200 tax-free threshold for such working holiday visa holders / backpackers regardless of their residency status (i.e. in contrast, tax resident individuals that are not working holiday makers will qualify for the tax-free threshold) and if such taxpayers do not provide their tax file number (TFN) to employers, employers must withhold tax at the top marginal rate (i.e. 45%).

An employer should only employ such holiday workers that have the correct visas to undertake gainful employment in Australia and also register as an employer of working holiday makers.

An employer that fails to register will be subject to penalties and will also have to withhold tax at 32.5% from each dollar earned up to $87,000.

4 APRIL 2018

Tips for keeping good records

In today’s electronic data-matching environment good record keeping is extremely important to substantiate claims for deductions, to obtain faster GST refunds and assist the business in operating more effectively.

We recommend that you adopt the following tips to ensure that your business keeps good records:

- Obtain valid tax invoices for all purchases that include GST;

- Keep accurate records of all sales and purchases;

- Make electronic copies of all your documents and ensure these are stored properly.

Remember that all relevant documents need to be kept for at least 5 years. Note that if CGT is payable when a landlord sells a property, accurate records should be kept over the ownership period and 5 years after selling the property – those records should comprise copies of the original purchase and sale contracts, details of improvements to the property, legal, real estate and valuers’ costs and other holding costs.

We would like to avoid any unnecessary stress, pressures and costs caused by an ATO audit of your business affairs and therefore we want to help your business adopt “best practices” methods to limit your risk of being subject to an ATO audit.

21 MARCH 2018

Ensure your ABN does not get cancelled

In 2018, the ATO intends to cancel Australian Business Numbers (ABNs) of businesses (e.g. sole traders, partnerships or trusts) that have not declared any business income in the last 2 years nor lodged business activity statements or income tax returns for more than 2 years.

If an ABN is cancelled, a business would not be able to quote an ABN on its invoices when the business makes sales to other businesses. In such a case (i.e. where no ABN is quoted) the purchasing business may withhold 47% of the sale price pursuant to the PAYG system (i.e. the purchaser may only pay the seller 53% of the sale price up-front).

If you are at risk of losing your ABN, please speak to your Nexia Advisor so that we can ensure your compliance obligations are up to date so that you do not need to suffer unnecessary cashflow problems due to PAYG withholding.

14 MARCH 2018

Some tricks and traps when applying for clearance certificates

As mentioned in a previous Top Tax Tips, we can help tax resident vendors to obtain ATO clearance certificates to avoid application of the 12.5% withholding rule when they sell their property for $750,000 or more. A clearance certificate – basically an ATO certificate confirming that the vendor is an Australian tax resident - provided to the purchaser before settlement date would enable such a vendor to receive 100% of the purchase price from the purchaser instead of only 87.5% of the purchase price at settlement.

Generally, tax resident entities owning properties directly (e.g. individuals or companies) have to apply for the clearance certificate themselves. However, for properties owned by a trust or superannuation fund, the trustee who has the legal title to the property, should apply for the clearance certificate using their own tax file number (if the trustee is an individual) or their own Australian Business Number (if the trustee is a company). If the corporate trustee does not have a TFN (or ABN), an attachment providing details of the relevant trust should be included in the application.

If more than one vendor is involved, each vendor must apply separately for a clearance certificate and if any of the vendors fails to provide such a clearance certificate to the purchaser, the purchaser may have to withhold 12.5% of the purchase price (in proportion to each vendor’s interest in the property).

28 FEBRUARY 2018

What is trust vesting?

Most Trusts have a cessation date called the vesting date. In most Australian jurisdictions, trusts have an 80 year life unless the Trust Deed specifies an earlier date or the appointor or trustee of the Trust vests (shuts down) the Trust.

Once a Trust has vested, the trust relationship comes to an end (i.e. the beneficial interests in income and capital in the trust becomes fixed and determinable) – and this will lead to tax consequences. For example, the CGT assets owned by the Trust are deemed to have been disposed of by the trustees to the beneficiaries on the vesting day - if the Trust’s CGT assets have increased in value since their acquisition, a taxable capital gain will arise.

Where the assets of the Trust were acquired before the commencement of CGT on 20 September 1985, the vesting of the Trust effectively causes those assets to become subject to CGT after the vesting. This is because upon vesting, the assets previously owned by the Trust become assets of the Trust’s beneficiaries. At this point, the assets should be market valued to establish their cost base.

A Trust’s vesting date cannot be extended by merely continuing to administer the trust in the same way as before the vesting date. Therefore, trustees of Trusts should be aware of when a trust may vest. For this reason, trustees are advised to read the trust deed to ascertain the vesting date.

If you have a Trust whose vesting date has either expired or is approaching its expiry date, you should contact your Nexia adviser to assist you in analysing your options.

14 FEBRUARY 2018

ATO visiting cash only businesses

As part of their campaign against businesses operating in the cash economy, the ATO is visiting businesses that predominantly make cash sales (e.g. restaurants, cafes, hair and beauty salons, building and construction industries).

Other factors that may prompt an ATO visit include businesses that:

- fail to register for GST or lodge activity statements or tax returns;

- fail to meet superannuation or employer obligations;

- operate outside the normal small business benchmarks for their industry; or

- have been reported by the community for potential tax evasion.

The ATO also makes extensive use of data matching which can determine whether income is being under-reported by comparing data from third parties.

Penalties can be significantly reduced by making a voluntary disclosure to the ATO of any unreported income or over-claimed tax deductions. In that event, the ATO is more amenable to arranging a debt repayment plan. The ATO is definitely less amenable if avoided tax is discovered during the course of an audit.

If you are deriving cash income from any business activities, please contact us so that we can help you comply with your tax and GST registrations, reporting, lodgement and payment obligations.

7 FEBRUARY 2018

Reminder: Single touch payroll starts 1 July 2018

As mentioned in previous Top Tax Tips, from 1 July 2018, the Single Touch Payroll (STP) system will be compulsory for all employers (that have 20 or more employees at 1 April 2018) to report payments such as salaries and wages, pay as you go (PAYG) withholding tax and superannuation contributions directly to the ATO at the same time they pay their employees.

Employers will no longer be required to prepare payment summaries to individuals or a payment summary annual report to the ATO.

Nexia has been in regular discussions with the ATO about the new STP system. Once the ATO releases information on how the ATO intends to administer the STP system, we will quickly release practical recommendations to assist employers to be STP ready by 1 July 2018.

Please talk to us (especially if you are likely to have 20 or more employees at 1 April 2018) so that we can assist you to transition to STP (i.e. to assist you to align the reporting of PAYG and superannuation contributions to the payroll process) as well as determine whether your payroll solution is STP-enabled (by following appropriate guidance once released).

7 FEBRUARY 2018

Potential tips to avoid attracting ATO attention

Although we cannot give taxpayers an exact checklist of what to do to avoid an ATO tax audit for possible under-reporting of income, the following broad principles / tips can be incorporated into a risk management plan of a business to assist in limiting potential exposure:

- Ensure all business takings are deposited into a business bank account (i.e. do not make such deposits into a taxpayer’s personal bank account where business and private funds can be mixed);

- Keep good records to keep track of income and expenses (e.g. by keeping good records, taxpayers would be able to substantiate income and expenses declared in their tax return) as well as trading stock used for private purposes; and

Ensure a taxpayer’s business is performing within the ATO’s small business benchmarks (e.g. if a taxpayer’s business performance indicators deviate from these small business benchmarks that were developed from comparing data from similar businesses in the same industry, an ATO audit/review may be more likely than not). Undoubtedly, the best defence with the ATO is to have comprehensive records.

Because we would like to avoid any unnecessary stress, pressures and costs caused by an ATO audit of your business affairs, we can help your business adopt “best practices” methods to limit your risk of being subject to an ATO audit.

24 JANUARY 2018

Are you a farmer affected by drought?

The ATO is offering assistance to primary producers affected by drought e.g. providing extra time to pay their taxes, waiving penalties or interest on late payments, offering payment plans as well as interest free periods and in cases of serious hardship, release such farmers from payment of some taxes.

If you are a farmer, please speak to us so that we can help you manage your tax obligations.

24 JANUARY 2018

A new (calendar) year and some tax new year’s resolutions!

Some individuals make personal New Year resolutions at the start of the calendar year.

Although the tax year of businesses are normally different from the calendar year (i.e. the tax year normally runs from 1 July to 30 June the following year), businesses wanting to make “tax” new year’s resolutions should not engage in the following types of business activities or events that may attract ATO attention:

- Low transparency of tax affairs;

- Tax and economic performance that is not comparable to similar businesses;

- Tax outcomes that are not consistent with the intent of the tax law (e.g. making controversial interpretations of the law);

- Business owners living an excessive lifestyle that is not supported by declared after-tax income;

- Business owners accessing business assets for tax-free private use; and

- Poor governance and risk-management systems in the business.

We can perform a tax health check of your affairs to ensure you are on the way to making your tax year a good tax year.

17 JANUARY 2018

Credit rating of taxpayers with outstanding tax debts may be affected

There is currently a proposal to allow the ATO to disclose certain outstanding business tax debts ($10,000 or more that is overdue for more than 90 days) to credit reporting agencies.

But under these proposals, such outstanding tax debts will not be subject to disclosure if taxpayers have made arrangements with the ATO to pay their tax debts or taxpayers have objected against their tax debt or applied to Courts for a review of an ATO decision.

The ATO believes that such a threat of disclosure (and potential negative effect on credit rating) will motivate taxpayers to engage more with the ATO and pay their debts sooner.

Although the ATO does not currently disclose information to credit reporting agencies, we would strongly encourage any business with current outstanding tax debts to engage with your Nexia contact to ensure outstanding tax debts are paid in a timely manner. We can assist a business in establishing a payment plan with the ATO to avoid or minimise penalties and late interest charges on outstanding tax debts, or alternatively your Nexia representative can arrange solutions to refinance and restructure your debts, in order to manage your cashflow.

20 DECEMBER 2017

Keep your wits about you: lowering of company tax rates and imputation

Currently two company tax rates can apply to companies (that are carrying on a business):

- For the year ended 30 June 2017, companies with turnover of less than $10 million will be subject to company tax at a rate of 27.5% (i.e. company tax will only be 30% if turnover is $10 million or more); and

- For the year ending 30 June 2018, companies with turnover of less than $25 million will be subject to company tax at a rate of 27.5% (i.e. company tax will only be 30% if turnover is $25 million or more).

From 1 July 2016 onwards, the rate at which dividends will be franked will depend on the company’s turnover of the previous year. For example, for the year ending 30 June 2018:

- If the turnover of the previous year (i.e. 2017) is less than the current year’s turnover benchmark ($25 million for 2018), the 2018 dividend will be franked at 27.5%; and

- If the turnover of the previous year (i.e. 2017) is equal to or more than the current year’s turnover benchmark ($25 million for 2018), the 2018 dividend will be franked at 30%.

Because company profits may be taxed at different rates from the rate at which these dividends are franked, the disparate tax treatment can lead to either:

- Over-franking of dividends (i.e. if company profits are taxed at 27.5% but franking is done at a rate of 30%) – in which case certain actions need to be undertaken to avoid the imposition of franking deficit tax; or

- Under-franking of dividends (i.e. if company profits are taxed at 30% but franking is done at only 27.5%) – in which case franking credits may become trapped and may not be usable.

Under proposals before the Parliament, companies will be subject to the lower 27.5% tax rate instead of the 30% tax rate, if they derive 80% or less of total income from passive activities. Activities that we currently understand to be non-business activities may also be regarded as business (not passive) activities that may be eligible for the 27.5% lower tax rate.

Because these changes and proposed changes are extremely complex, we would recommend that you speak to your Nexia adviser for assistance if you are operating in a corporate structure and/or planning to pay dividends.

13 DECEMBER 2017

Reminder: Single touch payroll starts 1 July 2018

As mentioned in various previous Top Tax Tips, from 1 July 2018, the Single Touch Payroll (STP) system will be compulsory for all employers (that have 20 or more employees at 1 April 2018) to report payments such as salaries and wages, pay as you go (PAYG) withholding tax and superannuation information directly. The reports must be sent electronically to the ATO at the same time they pay their employees.

Furthermore, information reported through STP will be pre-filled into business activity statements; i.e. employers will no longer be required to provide payment summaries to individuals or a payment summary annual report to the ATO.

We understand that some organisations are currently marketing their skills of being able to assist employers with all their STP issues – that is quite a bold promise – especially because the ATO has not yet finalised precisely how the STP system will work. We will advise all of our clients as soon as more precise details about the STP are known.

Please be assured that we will assist you to transition to STP - by assisting you to align the reporting of PAYG and superannuation contributions to the payroll process - as well as determine whether your payroll solution is STP-enabled (by following appropriate guidance once released).

6 DECEMBER 2017

The importance of keeping good records

Businesses should keep proper and consistent records to explain their business transactions and enable them to claim all the tax deductions (e.g. motor vehicle deductions, depreciation and home-based business expenses) to which they may be entitled.

One of the simplest ways to keep good records is to reconcile on a daily basis the amounts evidenced on the cash register tapes with the actual amount of cash received in the till.Businesses should not:

- Estimate their sales and income;

- Estimate their closing stock figures;

- Use the “no sale” and “void” button on their cash register when receiving cash payments from customers; or

- Pay their employees cash-in-hand.

Please be aware that the ATO receives many “dob-in” letters from disgruntled customers, employees and ex-spouses in relation to the non-payment of GST and income tax by businesses that do not record cash receipts and payments.

29 NOVEMBER 2017

Transactions a family trust should not enter into

Family trusts are used extensively in the SME market as a business or investment vehicle to accumulate wealth and to make distributions in a tax-effective way to beneficiaries.

Although most trusts are used appropriately (i.e. not for tax avoidance purposes), and may not necessarily trigger a full-scale ATO review or audit, the ATO is particularly concerned about trusts that have:

- not lodged tax returns or activity statements;

- offshore dealings with low tax jurisdictions; or

- entered agreements with no commercial basis or very complex sham transactions (e.g. where the economic benefits flow to a beneficiary on a higher marginal tax rate while tax on such a transaction is paid by a beneficiary on a lower marginal tax rate).

Because trust taxation is a very complex area of our tax law, please come and speak to us if you are thinking of entering a trust arrangement or are already using trusts in your business. Getting professional advice is a prerequisite when dealing with trust arrangements.

1 NOVEMBER 2017

Focus on cash economy

You may have heard that the ATO is on a campaign against businesses operating in the cash economy. Therefore, businesses that predominantly make cash sales (e.g. restaurants, cafes, hair and beauty salons) may be visited by ATO officers in the near future.

Specific factors that may prompt such an ATO visit include businesses identified because they:

- fail to register for GST or lodge activity statements or tax returns;

- fail to meet superannuation or employer obligations;

- operate outside the normal small business benchmarks for their industry; or

- have been reported by the community for potential tax evasion.

Penalties and interest will be charged on the tax avoided if cash sales are not declared in Business Activity Statements or income tax returns. Penalties can be significantly reduced by making a voluntary disclosure of the undisclosed income to the ATO and in that event, the ATO is more amenable to arranging a debt repayment plan. The ATO is definitely less amenable if avoided tax is discovered during the course of an audit.

If you are deriving cash income from any such activities, please contact us so that we can help you comply with your tax registration, reporting, lodgement and payment obligations as well as determine if the money earned should be subject to GST.

11 OCTOBER 2017

ATO focus on the cash economy

As part of their campaign against businesses operating in the cash economy, the ATO is visiting businesses that predominantly make cash sales (e.g. restaurants, cafes, hair and beauty salons, building and construction industries).

Other factors that may prompt such an ATO visit include businesses identified because they:

- fail to register for GST or lodge activity statements or tax returns;

- fail to meet superannuation or employer obligations;

- operate outside the normal small business benchmarks for their industry; or

- have been reported by the community for potential tax evasion.

The ATO also makes extensive use of data matching which can determine whether income is being under-reported by comparing data from 3rd parties.

Penalties can be significantly reduced by making a voluntary disclosure to the ATO of any unreported income. In that event, the ATO is more amenable to arranging a debt repayment plan. The ATO is definitely less amenable if avoided tax is discovered during the course of an audit.

If you are deriving cash income from any business activities, please contact us so that we can help you comply with your tax and GST registrations, reporting, lodgement and payment obligations.

27 SEPTEMBER 2017

Beneficiaries must quote their tax file number (TFN) to trustees

Beneficiaries of closely held trusts (e.g. a resident family trust or a trust that has up to 20 individual beneficiaries who between them have fixed entitlements to at least 75% of the capital or income of the trust) must quote their tax file number (TFN) to the trustee of the trust. Further, the trustee must lodge a TFN report with the ATO by the last day of the month following the end of the quarter in which the TFN was quoted to the trustee.

If a beneficiary does not provide their TFN, the trustee must withhold an amount (at the top tax rate of 47%) from any distributions made to the beneficiary, pay the withheld amount to the ATO and lodge an annual report with details of all withheld amounts.

Please contact your Nexia adviser if you are a beneficiary of a family trust so that we can ensure that you do not fall foul of these reporting rules.

20 SEPTEMBER 2017

Can your business qualify for tax concessions?

Small businesses may be able to qualify for a variety of concessions:

If the turnover of your business is below any of the benchmarks mentioned above, please come and speak to us so that we can determine help you claim these concessions you may be entitled to.

6 SEPTEMBER 2017

How can an export market development grant (EMDG) help your business?

The EMDG scheme is a Government program which provides Australian businesses with significant cash rebates (e.g. a rebate of up to $150,000 and/or reimbursement of up to 50% of eligible expenditure incurred) for aspiring and current exporters. The scheme supports a wide range of industry sectors and products for the export including intellectual property and know-how outside Australia.

If you are thinking of expanding your business overseas, please talk to your Nexia representative so that we can identify the most relevant EMDG opportunities for you, prepare and lodge the application forms, and calculate your potential benefit.

6 SEPTEMBER 2017

Issues that attract the ATO’s attention

The ATO has warned that they will publicly target family businesses that do not do the “right thing” such as businesses that have:

- Kept improper and inconsistent records to explain business transactions;

- Described personal expenses (e.g. family car, family holidays or school fees) as business expenses;

- Incorrectly used loan accounts to borrow money from the business without ever paying the loan back;

- Used very complex trust structures for simple businesses;

- Mismatched information between business activity statements (BAS) and income tax returns;

- Continued to trade while insolvent; and

- Been operating in the cash economy.

We can perform a tax and financial health check on your business to ensure your business is in top shape.

30 AUGUST 2017

Be aware of the different small business thresholds

There are various tax breaks available for small businesses depending on whether the business structure is a company, partnership, trust or sole trader:

- For this current year ending 30 June 2018, companies with an aggregated turnover of less than $25 million will only pay tax at 27.5% (companies with an aggregated turnover of $25 million or more will pay tax at 30%); and

- For the year ended 30 June 2017 and onwards, non-corporate small businesses (e.g. sole traders, partnerships or trusts) that have an aggregated turnover of less than $5 million, can reduce the tax the individual (e.g. sole trader, partner of a partnership or beneficiary of a trust) pays by 8% (up to a maximum discount of $1,000) per income tax year.

Furthermore, any business (whether corporate or non-corporate) that is a small business entity (SBE) with an aggregated turnover of less than $10 million a year, may qualify for further concessions (e.g. $20,000 instant asset write-off and simplified depreciation, small business restructure rollover and an immediate deduction for business start-up costs and prepaid expenses) in addition to those concessions mentioned above.

23 AUGUST 2017

Property developers incorrectly claiming the CGT discount

Property developers using trusts as their business structure should be aware that their business income is taxed as trading income and not as capital gains. The reason why a business would rather prefer to be taxed under the capital gains tax regime is to gain the benefit of the 50% CGT general discount.

In limited circumstances, such as when a property developer constructed and then rented a property for ten years, any profit on the sale of the property may be subject to CGT.

23 AUGUST 2017

Sole traders must always lodge tax returns (regardless of income earned)

Some sole traders earning less than the $18,200 tax-free threshold are under the misapprehension that they do not need to lodge tax returns. Some of these people may consider that they are not conducting a business but instead, a hobby.

We would be pleased to advise on whether a person is conducting a business or hobby and, if necessary prepare a tax return for the current or prior income years.

Some people out-grow their sole trader business structure and require the financial comfort of limited liability that is offered by a company or trust with a company trustee. Movement from one structure to another may be possible without capital gains or income tax consequences. Advice should be sought from your Nexia contact before embarking on any business restructures.

16 AUGUST 2017

Tips and traps when amending a trust deed

With all the recent talk in the media about trusts and Labor’s proposed changes to the taxation of family trusts, some clients have started thinking about whether they should amend their trust deeds.

A trust deed may only be amended if the deed establishing the trust has a clause giving a specific power of amendment - such a power usually offers a roadmap on how to validly amend the deed.

Failure to apply such an amendment clause correctly (e.g. an unauthorised person attempts to amend a trust deed or certain other amendment procedures are not met) may result in the amendment being invalid. An invalid amendment may also result in the trust being resettled with the consequence of an unexpected capital gains tax liability.

Because trust law is complex, please speak to your Nexia adviser about whether your trust strategy is still suitable for you in this changing business environment, or whether you should consider a new kind of business or investment vehicle for your business or family affairs.

16 AUGUST 2017

Home-office expenses, travel expenses and $20,000 instant asset write-off

In general, expenses incurred in conducting a taxpayer’s business (e.g. staff wages, marketing and business finance costs) will be tax deductible – provided such expenses are not private in nature (i.e. not incurred for personal use).

Other rules are:

- taxpayers who operate a business from home can only claim part of the mortgage interest, rates and electricity expense that relate to the business use (apportionment usually based on the floor surface occupied by the home office). Please note that claiming tax deductions for mortgage interest and rates will affect the main residence CGT exemption on the house. But claiming tax deductions for electricity and gas charges usually does not affect the main residence CGT exemption.

- taxpayers who incur business travel expenses (e.g. airfares, train, bus or taxi fares of business owners or employees that travel for work) as well as accommodation costs and meal expenses (for overnight business travel) may also claim a tax deduction. Different rules may apply when a travelling allowance is paid.

- Taxpayers that are small business entities (i.e. broadly businesses with an aggregated turnover of less than $10 million a year) can claim the business proportion of depreciating assets costing less than $20,000 immediately (please see our recent tax update for more information).

9 AUGUST 2017

Building & construction businesses to report payments made to contractors by 28 August 2017

Taxpayers operating in the building and construction industry (e.g. builders, architects, engineers, project managers, painters and landscapers) must lodge their Taxable payments annual reports, detailing the total payments made to contractors in 2017, with the ATO by 28 August 2017. Penalties may apply for late lodgement.

26 JULY 2017

Sole traders must always lodge tax returns (regardless of income earned)

There is a misconception that sole traders earning less than the $18,200 tax-free threshold do not need to lodge tax returns.

Please contact us if you are a sole trader who has not lodged a tax return so that we can assist you to lodge your individual tax return (including the supplementary section) as well as the business and professional items schedule for individuals.

If you no longer want to operate as a sole trader, we can also assist you to restructure your business into a more suitable structure depending on your specific circumstances (e.g. through making use of the new restructure rollover).

12 JULY 2017

Media speculation that 27.5% tax rate may apply to passive investment companies

There has been recent media speculation that passive investment companies may also qualify for the lower 27.5% tax rate.

The Government’s clear intention was that the lower tax rate of 27.5% was never meant to apply to passive investment companies. We understand that the Government may amend the law to make clear that the new 27.5% company tax rate will only apply to companies operating a trading business

Nexia will keep you updated if there are any changes to the status quo.

5 JULY 2017

You may not have to do a stocktake for 2017

Because the threshold for determining whether a business is a small business entity has been increased to $10 million (from $2 million) from the 2017 income tax year onwards (see our previous Top Tax Tips here), businesses with an aggregated turnover of less than $10 million may not need to do a stocktake for tax purposes.

From 1 July 2016 businesses will only need to do a stocktake if:

- Their business turnover is $10 million or more; or

- The business estimates that the difference between the opening and closing stock at the beginning and end of the income tax year is more than $5,000.

Despite the tax law not requiring a stocktake for such businesses, the estimated difference in opening stock at 1 July 2016 and closing stock at 30 June 2017 must still be capable of being verified in the event of an ATO review. For very small businesses, the difference in stock values may be small but larger businesses may still need to do a stocktake to be able to demonstrate that the difference is less than $5,000.

While the tax law rules regarding trading stock are mandatory, many businesses find significant commercial advantages are gained from undertaking a least one stocktake per year to gauge poor performing stock, correct pricing of stock, stock ordering processes, theft of stock by customers or employees or whether obsolete or out of date stock should be discarded. Your Nexia contact can assist you with any commercial or tax issues relating to stock including real time reporting of stock levels to improve profitability.

28 JUNE 2017

More compliance for employers of working holiday visa holders / backpackers

As mentioned in a previous Top Tax Tips, working holiday visa holders / backpackers will be taxed at a flat rate of 15% (from the first dollar earned) on earnings up to $37,000 from 1 January 2017.

These changes mean that employers of such workers must:

- register with the ATO so that the employer can withhold tax at the new 15% rate – note, such an employer only needs to register once (i.e. they do not need to register each time they hire a new worker or for each income year);

- check each new and existing working holiday maker has the correct visa;

- issue two payment summaries for the 2017 income tax year (i.e. one for the period up to 31 December 2016 and another for the period from 1 January 2017 to 30 June 2017).

Please contact us if your business is currently employing or will employ backpackers / working visa holders.

We can ensure the business registers as an employer of working holiday visa holders and thereby ensure that the workers will not be subject to a 32.5% withholding rate (as opposed to only 15%) for earnings up to $37,000 and ensure penalties for failing to register are avoided.

21 JUNE 2017

Issues that attract the ATO’s attention

The ATO warned that family businesses displaying the following types of “red flags” may expect a visit from the ATO in due course:

- the business recently concluded a large one-off or unusual transaction;

- the business has a history of aggressive tax planning or regularly takes controversial interpretations of the law;

- the business owner’s lifestyle is not supported by the owner’s after-tax income or business assets are used privately; or

- the business has poor governance and risk-management systems.

Please contact us if you believe you may be on the ATO radar or if the ATO is currently asking questions. We can assist you with answering ATO queries as well as help you to manage an ATO audit or review process. We can also help you with the design and implementation of effective governance and risk-management systems in your business.

21 JUNE 2017

Easier to lodge activity statements from 1 July 2017

As mentioned in a recent Top Tax Tips, from 1 July 2017, businesses with a GST turnover of less than$10 million will be able to lodge simplified business activity statements (BAS), in that such businesses:

- will only have to inform the ATO about GST on purchases and total sales (instead of filling in a number of other labels that may not be relevant to the business);

- will be able to electronically lodge a nil activity statement with just one click (i.e. without having to fill in each label with a zero); and

- will be able to sign the declaration by merely clicking a checkbox (i.e. without having to use AUSkey or myGov credentials).

14 JUNE 2017

Make your trust resolutions before 30 June

Trustees of discretionary trusts are reminded to make trust resolutions (i.e. decide how to distribute the income of the trust to the beneficiaries) before 30 June 2017 (or an earlier date if the trust specifies such an earlier date).

Failure to make such a trustee resolution may lead to a trustee assessment at the top marginal tax rate on all of the trust’s net income (if the trust deed does not contain a default/balance beneficiary clause).

Because the tax laws dealing with trusts are very complex, please speak to your Nexia Adviser about your trust’s 2017 resolution and potential strategies when dealing with trusts.

24 MAY 2017

Special current focus on cash-only businesses

As part of the ATO’s campaign against businesses operating in the cash economy, the ATO is visiting businesses that predominantly make cash sales (e.g. restaurants, cafes, hair and beauty salons).

The ATO are also identifying businesses for a visit where the business:

- fails to register for GST, lodge activity statements or tax returns;

- fails to meet superannuation or employer obligations;

- operates outside the normal small business benchmarks for their industry; or

- if the business is reported by the community for potential tax evasion.

The ATO also makes extensive use of data matching (e.g. determining under-reporting of income by comparing data from 3rd parties) to identify when such cash sales are not declared.

Penalties can be significantly reduced by making a voluntary disclosure to the ATO and in that event, the ATO is more amenable to arranging a debt repayment plan. The ATO is definitely less amenable to payment plans if avoided tax is discovered during the course of an audit.

If you are deriving cash income from business activities, please contact us so that we can help you comply with your tax and GST obligations.

18 APR 2017

Change in tax rate for super payments to backpackers from 1 July 2017

As mentioned in previous Top Tax Tips, from 1 January 2017, the Government will tax working holiday visa holders / backpackers at a flat rate of 15% on earnings up to $37,000 with ordinary marginal rates of tax applying after that.

Furthermore, from 1 July 2017, if a backpacker leaves Australia after the working holiday, any superannuation contributions made on behalf of such backpackers will be taxed at 65% (giving rise to an effective tax rate of 55.25% - because contributions into the fund will be taxed at 15%).

Note that payments made before 1 July 2017 will be taxed at 38% on the taxed element and 47% on the untaxed element.

12 APR 2017

Remember to account for trading stock you use for private purposes

If you use an item of trading stock for personal use (e.g. if you consume a cake that was baked in your bakery) – you can’t just ignore this transaction – but will have to treat this transaction as a sale of trading stock and include the value of the trading stock in your assessable income in your annual income tax return.

Because keeping track of the value of trading stock used for private purposes over the course of the year may be difficult, the ATO publishes industry–specific guidelines each year that sets out what would be a reasonable estimate of the value of such consumption of trading stock in that particular year.

Please contact us if you or your family consume your business’s trading stock (e.g. such as a bakery, butcher, restaurant, caterer, delicatessen, greengrocer, takeaway food shop or convenience store) so that we can ensure that you treat the private consumption of trading stock correctly.

12 APR 2017

Are you affected by Cyclone Debbie?

If you have recently been affected by natural disasters (e.g. the recent Cyclone Debbie), lodging tax returns is probably the last thing on your mind.

However, once you are ready to turn your mind to operating your business again, the good news is that if your business has a postcode in a Cyclone affected area, you should receive an automatic one month deferral of lodgement obligations (e.g. tax returns that were due 31 March 2017 will now be due 30 April 2017)

Even if you do not qualify for the automatic deferral, but have been affected by the Cyclone, we can negotiate with the ATO on your behalf to assist you to:

- Obtain lodgement deferrals of activity statements and tax returns without penalty;

- Obtain additional time to pay tax debts without incurring general interest charges (GIC);

- Make arrangements to pay debts by instalments and fast-track refunds; and

- Vary your PAYG instalments.

If records have been lost in the natural disaster, we can also assist you in reconstructing your records.

5 APR 2017

Small business tax cuts – the uncertainty lingers

As reported in previous Top Tax Tips and recent Nexia article, the Government is proposing to make a whole raft of changes to the business landscape in which small businesses operate.

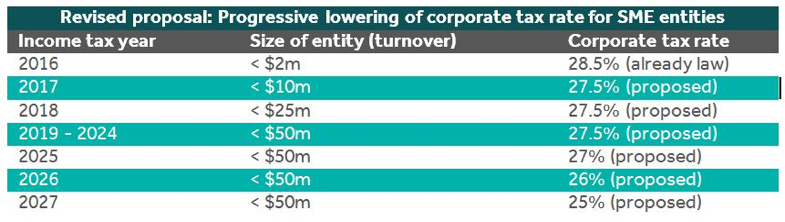

The original main proposal was an ambitious plan to gradually lower the corporate tax rate to 25% in 2027 for all companies (regardless of size). However, this 10-year plan has now been replaced by a revised proposal that will only lower the tax rate to 25% in 2027 for companies with a turnover of less than $50 million:

Under this revised proposal, companies with a turnover of $50 million or more will always be subject to a 30% corporate tax rate.

Unfortunately, the relevant legislation has not yet been enacted; that will not occur until Parliament sits again on 9 May 2017 (i.e. the day of the Federal Budget)

Keep reading Top Tax Tips for an update on developments in this very important area.

Updated small business benchmarks

The ATO announced the latest benchmarks for small businesses.

As you are aware, these benchmarks can either be used as a business performance tool (where you can compare the performance of your small business against those in the industry) or as a compliance decision-making tool (giving you an indication whether the ATO may select your small business for an audit if the benchmarks are not satisfied).

Please contact us to help determine whether your small business falls within the ATO’s benchmarks for your specific industry and, should the benchmarks not be satisfied, for advice on what next steps to take to minimise the risk of an ATO audit.

15 MAR 2017

Clamp down on cash economy – certain businesses targeted

You may have heard that the ATO is on a campaign against businesses operating in the cash economy. Therefore, businesses that predominantly make cash sales (e.g. restaurants, cafes, hair and beauty salons) may be visited by ATO officers in the near future.

Penalties and interest will be charged on the tax avoided if cash sales were not declared. Penalties can be significantly reduced by making a voluntary disclosure to the ATO and in that event, the ATO is more amenable to arranging a debt repayment plan. The ATO is definitely less amenable if avoided tax is discovered during the course of an audit.

If you are deriving cash income from any such activities, please contact us so that we can help you comply with your tax registration, reporting, lodgement and payment obligations as well as determine if the money earned should be subject to GST.

Let us help your business with tax governance

Many business owners and family owned businesses realise how important a good business governance system is when operating a business.

In addition to helping you with the ordinary day-to-day activities of operating your business, Nexia can assist in managing your tax obligations and risk – both from a tax compliance (e.g. making sure you meet your obligations and that you are paying the right amount of tax in BASs and income tax returns), as well as providing tax advice on what is the best way to structure your business transaction or what new tax developments may have an effect on how you run your business.

Please speak to your Nexia adviser so that we can assist you to manage the tax risks that usually arise when the following business or life events happen to you:

- Starting and finishing a business;

- Business expansion including funding and finance analysis;

- Succession planning;

- Retirement planning;

- Self-managed superannuation fund (SMSF) management;

- Estate planning; and

- Philanthropy.

21 DEC 2016

Important information if you employ backpackers from 1 January 2017

As mentioned in a previous Top Tax Tips, working holiday visa holders / backpackers will be taxed at a flat rate of 15% on earnings up to $37,000 from 1 January 2017 and employers of such workers will be required to register with the ATO.

Because the 15% rate is different from the usual PAYG withholding rates, the ATO published a specific “backpacker” withholding schedule to calculate the exact amount employers will need to withhold in respect of these types of workers. If employers did not register with the ATO before they employed a working holiday maker, they will have to withhold PAYG at the higher foreign resident rates.

Keep reading Top Tax Tips for more information on the Backpacker tax or contact your Nexia representative.

30 NOV 2016

Remember to account for trading stock you use for private purposes

Business owners who take an item of trading stock for their personal use (e.g. if they consume a cake that was baked in their bakery) – cannot ignore the transaction - and will have to treat this transaction as a sale of trading stock and include the value of the trading stock in the business’s assessable income.

Because keeping track of the value of trading stock used for private purposes over the course of the year may be difficult, the ATO publishes industry–specific guidelines each year that sets out what is a reasonable estimate of the value of such withdrawals from trading stock in that particular year.

Please contact us if you are involved in an industry that has a high turnover of items (e.g. such as a bakery, butcher, restaurant, caterer, delicatessen, greengrocer, takeaway food shop or convenience store) so that we can ensure that you treat private use of trading stock items correctly.

19 OCT 2016

Small Businesses – You must be SuperStream ready by 28 October 2016

We note that small businesses (i.e. those with less than 20 employees) must adopt SuperStream from 28 October 2016 (i.e. must adopt a SuperStream payment standard which excludes use of cheques, EFT or BPay to make direct payments).

Please contact us if you have any problems with your SuperStream obligations or if you need help updating your systems to ensure you are SuperStream ready by 28 October 2016 (for small businesses).

5 OCT 2016

Small Businesses – Are you SuperStream ready?

The ATO has questioned whether large businesses (i.e. those with 20 or more employees who have been using SuperStream since 31 October 2015) are using SuperStream correctly – particularly if they still use cheques, EFT or BPay to make direct payments (i.e. without using a SuperStream payment standard).

We note that small businesses (i.e. those with less than 20 employees) must adopt SuperStream from 28 October 2016.

Please contact us if you have any problems with your SuperStream obligations (for large businesses) or if you need help updating your systems to ensure you are SuperStream ready by 28 October 2016 (for small businesses).

14 SEP 2016

Tax changes for small businesses

The following changes to small businesses apply from 1 July 2016:

- increase the small business entity turnover threshold from $2 million to $10 million – entitling more small businesses to various tax concessions (e.g. the small business restructure rollover);

- reduce the corporate tax rate to 27.5%; and

- increase the unincorporated small business tax discount from 5% to 8% (but still capped at $1,000 per year per individual).

For a more detailed analysis of the impact that these proposals may have on your business, please join Nexia Australia in September and October 2016 for various complimentary client-presentations throughout Australia to learn more about the various tax issues and opportunities that may affect the way you operate your small business.