On 27 March 2024 the Federal Government introduced a Bill into Parliament to mandate climate-related financial disclosures in an entity’s annual report.

The Bill is broadly consistent with the exposure draft legislation issued by Treasury in January 2024 but with some differences.

Summary

The key elements of the Bill include –

- Start date: Linked to the passage of the legislation but will be no earlier than 1 January 2025. This is at least six months later than Treasury proposed in its January 2024 consultation.

- Reporting basis: As required by Australian Sustainability Reporting Standards (ASRS). Group 3 entities would only be required to make climate-related financial disclosures if they are subject to material climate-related risks or opportunities for the reporting period. Where Group 3 entities assess that they do not have material climate-related risks or opportunities, they would only be required to disclose a statement to that effect.

- Directors’ declaration on sustainability reports: A modified form of the directors’ declaration will apply for the first three years, whereby the directors will declare ‘the entity has taken reasonable steps to ensure the substantive provisions of the sustainability report are in accordance with’ the Corporations Act.

- Assurance requirements: Phased approach to be determined by the AUASB in relation to financial years commencing on or before 30 June 2030. For financial years commencing on or after 1 July 2030, the sustainability report is required to be audited. In addition, the Bill proposes that the auditor is required to form an opinion as to whether the entity has kept sustainability records sufficient to enable the sustainability report to be prepared and audited.

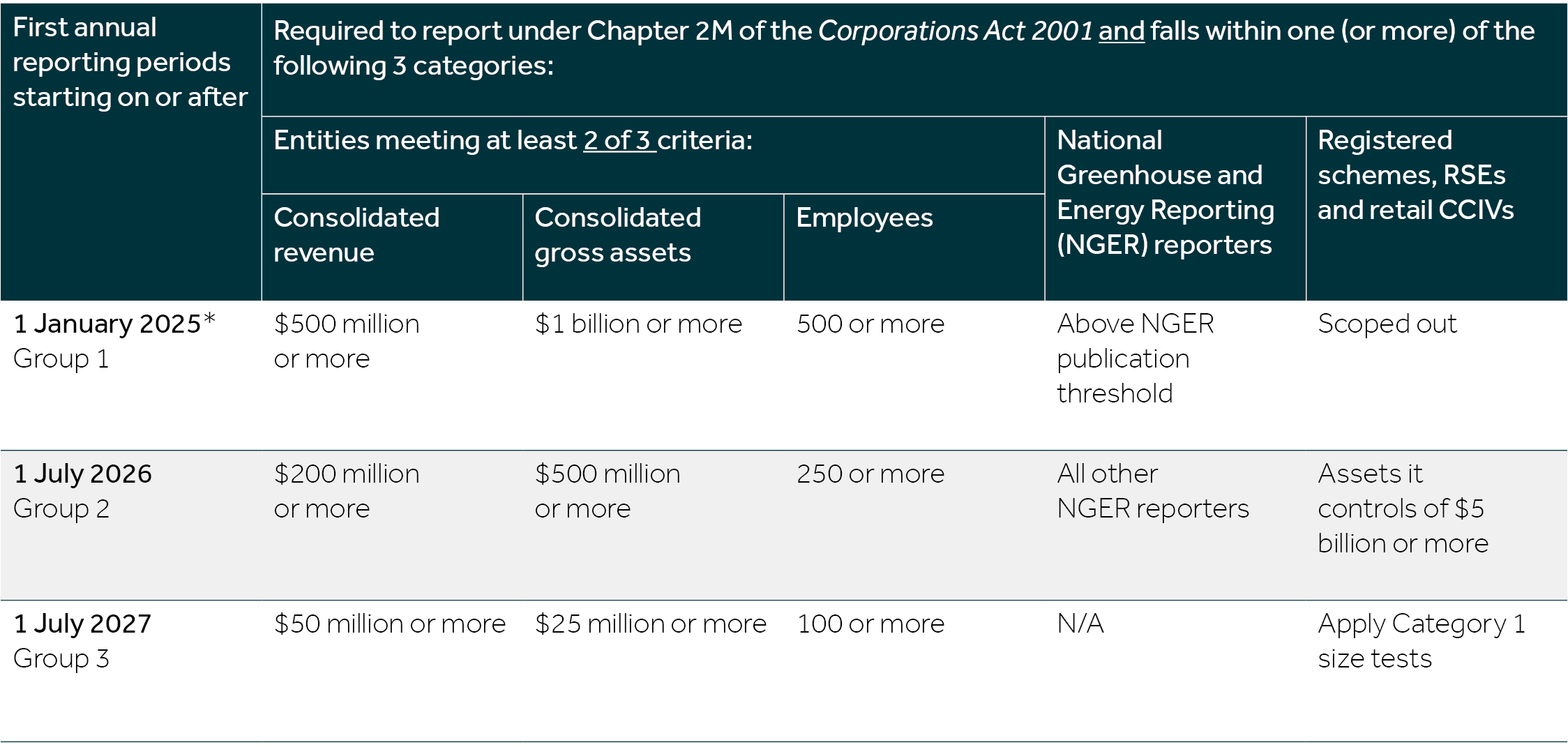

- Reporting entities: Only those entities required to report under Chapter 2M of the Corporations Act 2001 and meet prescribed size thresholds.

- Reporting deadlines: A sustainability report forms part of an entity’s annual report and is subject to the same relevant annual financial reporting timetable.

- Liability framework: Up to three years limited liability for directors and auditors relating to disclosures of Scope 3 emissions, scenarios analysis, and climate-related forward-looking statements.

Reporting entities and phasing

Three categories of entities will be subject to mandatory climate-related reporting. These are entities that are required to prepare an annual report under Chapter 2M of the Corporations Act, and either:

- Meet at least two of three size thresholds relating to consolidated revenue, consolidated assets, and employees; or

- Are subject to emissions reporting obligations under the National Greenhouse and Energy Reporting Act 2007 (NGER Act), regardless of size; or

- Are registrable superannuation entities (RSE), registered schemes, and retail CCIVs over specified size thresholds.

The start date for mandatory climate-related financial disclosures for Group 1 entities will be linked to when the enabling legislation commences. If the legislation is enacted on or before 2 December 2024, the Group 1 start date will be 1 January 2025 (i.e., 31 December 2025 for December year-ends and 30 June 2026 for June year-ends). However, if the legislation is enacted between 3 December 2024 and 1 June 2025, the Group 1 start date will be 1 July 2025 (i.e., 30 June 2026 for June year-ends and 31 December 2026 for December year-ends). If the start date is not 1 January 2025 or 1 July 2025, Group 1 entities would report in accordance with the Group 2 timetable below.

*Subject to passage of legislation prior to 3 December 2024.

The Bill would require large proprietary companies to report climate-related information from 1 July 2027 (i.e., 30 June 2028 or 31 December 2028 year ends). Entities below the relevant size thresholds and those that are exempt from preparing financial reports under Chapter 2M of the Corporations Act, including where exemptions have been made through ASIC class orders or where the entity is registered with the Australian Charities and Not-for-profits Commission, will not be required to make climate-related financial disclosures.

A large company limited by guarantee with annual (consolidated) revenue of $1 million or more required to prepare an annual financial report is only required to prepare climate-related information if it also meets any of the other sustainability reporting thresholds.

Consolidated entities

The sustainability reporting requirements apply to each entity that satisfies the above criteria. However, if a parent entity is required by accounting standards to prepare consolidated financial statements, it may choose to prepare its sustainability report also on a consolidated basis. In this case, each other group entity that is otherwise required to prepare a sustainability report would not need to, provided the consolidated sustainability report covers those individual entities.

Reporting requirements

A company’s annual report will now comprise four separate reports:

- A Director’s Report;

- The Financial Report, comprising the financial statements, notes to the financial statements, and a directors’ declaration on the statements and notes;

- A Sustainability Report, comprising the climate statements, notes to the climate statements, and a directors’ declaration on the statements and notes; and

- Auditor’s Reports.

Climate statements will be prepared based on sustainability standards that will be issued by the Australian Accounting Standards Board (AASB). The AASB published its exposure draft ED SR1 Australian Sustainability Reporting Standards – Disclosure of Climate-related Financial Information in October 2023.

A modified form of the directors’ declaration on the climate statements will apply for the first three years, whereby the directors will declare that ‘the entity has taken reasonable steps to ensure the substantive provisions of the Sustainability Report are in accordance with’ the Corporations Act 2001. After the transition period, the directors will declare that ‘the substantive provisions of the Sustainability Report are in accordance with’ the Act.

Group 3 materiality exemption

Group 3 entities will be required to make climate-related financial disclosures if they face material climate-related risks or opportunities during the financial reporting period. Materiality will be assessed in accordance with the sustainability accounting standards. Where a Group 3 entity assesses that it does not have material climate-related risks or opportunities, it is still required to include a Sustainability Report that would include a statement to that effect. The entity would still be required to include a directors’ declaration covering that statement and have the statement audited.

Sustainability reporting dates

Because a Sustainability Report forms part of an entity’s Annual Report, the timing of lodgement of the Sustainability Report with ASIC and reporting to members will follow the current annual financial reporting timing requirements.

Under section 319 of the Corporations Act disclosing entities and registered managed investment schemes are required to lodge their financial report with ASIC within three months after the end of the financial year, and all other companies within four months after the end of the financial year.

The Sustainability Report must be sent to members and, where relevant, considered at an entity’s Annual General Meeting, in accordance with the relevant timing requirements for the Annual Report.

Assurance requirements

Climate disclosures will be subject to similar assurance requirements to those currently applicable in the Corporations Act for financial reports and will require entities to obtain an assurance report from their auditors.

The Australian Auditing and Assurance Board (AUASB) is developing a pathway for phasing in assurance requirements over time. The AUASB issued its revised Consultation Paper – Assurance over Climate and Other Sustainability Information on 4 April 2024 for public comment.

Auditor independence requirements are expected to apply equally to a company’s Financial Report and Sustainability Report.

Liability framework

Climate disclosures will be subject to the existing liability framework under the Corporations Act and Australian Securities and Investments Commission Act 2001 including: director’s duties, misleading and deceptive conduct provisions, and general disclosure obligations. This is designed to ensure directors engage fully with their climate disclosure obligations.

However, limited immunity from liability will apply for company directors and auditors for a three year period commencing from the start date of the legislation for disclosures relating to Scope 3 emissions, scenario analysis and transition plans.

Limited immunity would also apply to forward-looking statements made in relation to climate but only for the first 12 months commencing from the start date of the legislation. Effectively, this relief will only apply to Group 1 entities.

The nature of the limited immunity means that the regulator will still be able to take action relating to misleading and deceptive conduct in relation to protected statements, but no other legal action is able to be brought against a person or entity.

Beyond the limited immunity period, the existing liability framework under the Corporations Act and Australian Securities and Investments Commission Act will apply.

Next steps

The Bill was referred to the Senate Economics Committee which will report by 30 April 2024. The Bill then needs to be debated and pass both Houses of Parliament before it can become law. It is possible that further amendments to the proposals will occur before the Bill is enacted.

Speak with your trusted Nexia advisor if you have any questions about the matters discussed in this article.