A recap of what Australia is doing to combat multinational tax avoidance

What happened?

As you may be aware, the Australian government has been on a crusade against multinationals that shift their pro ts out of Australia – thereby avoiding paying their share of Australian tax on their Australian profits.

In an attempt to curb this kind of multinational behaviour (and prevent further revenue leakage from Australia), the Government proposed the following measures in the recent 2015 Budget1:

- amend2 Australia’s general anti-avoidance provision (i.e. Part IVA) to catch multinationals that are artificially trying to avoid having a taxable presence in Australia (so as to avoid Australian taxation pursuant to current source and residency rules);

- impose double penalties for tax avoidance; and

- implement country-by-country transfer pricing documentation standards.

Broadly, these proposals would affect multinational enterprises with global revenue of $1 billion or more. Therefore these proposals may apply to the smallest Australian subsidiary or branch that forms part of such a large multinational.

Although these proposals are not yet law (i.e. so far only draft legislation has been released3), if/when these measures are enacted, they may change the way multinationals do business with / in Australia.

What does this mean for you?

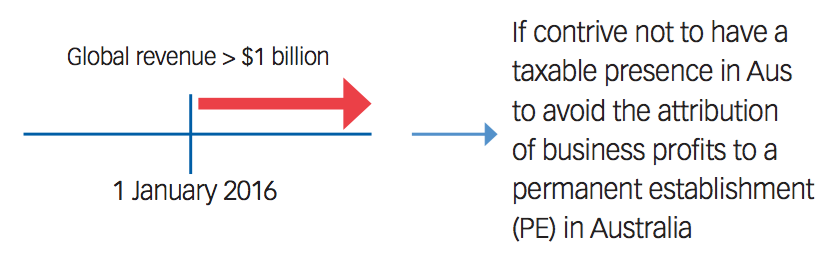

1. Amendments to Part IVA to catch multinationals

- Global revenue > $1 billion

- From 1 January 2016

- If try to avoid having a taxable presence in Australia

Broadly, this new draft law will target about 30 companies (with global revenue of more than $1 billion in the relevant year in which they sought the tax benefit) in situations where a foreign resident will pay no Australian tax on income it made through a structure which would have avoided giving rise to a taxable presence / permanent establishment (PE) in Australia.

In particular, the new draft law should apply if:

- the activities of the Australian entity is integral to an Australian customer’s decision to enter into a contract;

- the contract is formally entered into with a foreign related party of that Australian entity;

- the profit from the Australian sales is booked overseas and subject to low or no global tax; and

- the transaction was entered into for the principal purpose of avoiding tax.

It will be interesting to see how other countries react to this unilateral approach by Australia, especially in light of the multi-jurisdictional base erosion profit shifting (BEPS) program that aims to use a co-ordinated multilateral country approach to combat tax avoidance by multinationals.

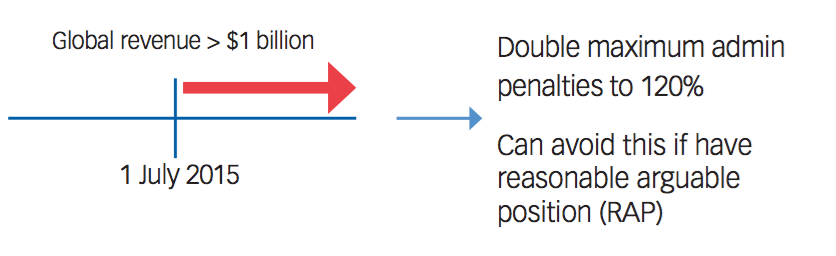

2. Double penalties for tax avoidance

- Global revenue > $1 billion

- From 1 July 2015

- Keep adequate documentation

From 1 July 2015, the Government intends to double the maximum administrative penalties4 (i.e. increase the maximum penalty rate from 60% to 120% of the amount of tax avoided under a scheme) that can be imposed on large companies (i.e. those with global revenue of more than $1 billon) that have entered into tax avoidance and profit shifting schemes.

However, taxpayers who have a reasonably arguable position (RAP) substantiated by adequate Australian specific transfer pricing documentation5, should not be affected by these increased penalty rates.

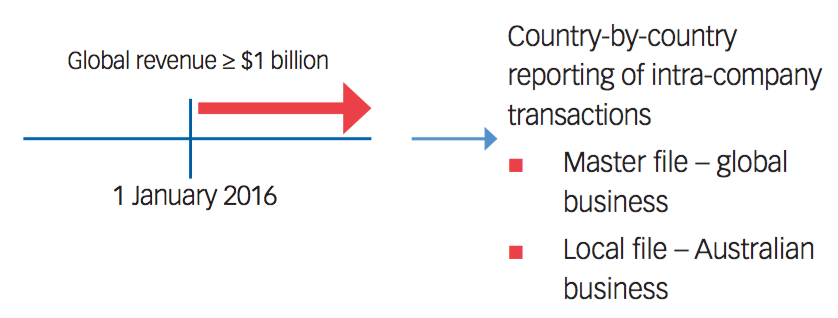

3. Country-by-country transfer pricing reporting

- Global revenue ≥ $1 billion

- From 1 January 2016

- Are you subject to CBC reporting?

Pursuant to this country-by-country reporting proposal6, multinationals operating in Australia (with annual global revenue of $1 billion or more), will have to provide the following documents to the ATO before the end of the next income year:

-

a country-by-country (CBC) report showing information on the global activities of the multinational (and the location of its income and taxes it paid);

-

a master file containing an overview of the multinational’s global business, its organisational structure and its transfer pricing policies; and

-

a local file that provides detailed information about the local company’s intercompany transactions.

These reports will provide the ATO with a global overview of the multinational entities’ operations, assist them in carrying out transfer pricing risk assessments and help to identify tax avoidance.

Since such reports will only need to be led in the parent entity’s jurisdiction, entities operating in Australia will generally only be subject to this CBC reporting if they are:

- Australian headquartered multinational enterprises (i.e. so that they can le the report with the ATO themselves); or

- Australian subsidiaries of multinational enterprises headquartered outside Australia (e.g. if the foreign parent has not provided the report to the foreign tax department).

If such entities do not provide the required CBC reporting, they may be liable to a base administrative penalty7 or criminal sanction – however, they would still be eligible to have a reasonably arguable position in relation to a transfer pricing matter if they meet the Australian documentation requirements.

How can Nexia help you?

To comply with Australian transfer pricing rules has become a daunting task.

Not only do you have to consider a number of factors8 to determine the appropriateness of your transfer pricing methodology, but you also need to conduct a functional analysis to prepare a risk-appropriate level of documentation to “justify” your transfer pricing methodology adopted.

Unfortunately these recent transfer pricing proposals discussed above do not make the transfer pricing compliance process any easier.

Please contact your Nexia advisor if you would like to discuss how transfer pricing may affect your organisation and so that we can help you identify potential transfer pricing risks and opportunities.

Our Australian team has considerable cross-border tax experience and coupled with our international network, we can offer you a global business-wide view to get the best outcome for you.

1 - Delivered on 12 May 2015 (for background, please see our budget alert on the Nexia website – www.nexia.com.au)

2 - The current Part IVA only applies to arrangements entered into for the purpose of obtaining an Australian tax benefit. Therefore, multinationals that enter into global arrangements for the purpose of avoiding tax in other countries – resulting in only a relatively small Australian tax benefit - may arguably not be caught by the current Part IVA.

3 - Tax integrity multinational anti-avoidance Law - 12 May 2015; Stronger penalties to combat tax avoidance and profit shifting – 6 August 2015; and Country-by-country reporting and new transfer pricing documentation standards – 6 August 2015.

4 - Division 284 of the Taxation Administration Act 1953

5 - See Nexia Alert on the Nexia Australia website (www.nexia.com.au) – Added documentation compliance & risk – August 2014

6 - This proposal will implement Action 13 of the G20 and the OECD’s Action Plan on Base Erosion and Profit Shifting (BEPS Action plan).

7 - Five penalty units (i.e. 5x$180 = $900) for each period of up to 28 days from when the document was due to a maximum of 5 periods (so potentially $4,500).

8 - Factors include the overall commerciality of the arrangement as well as the pricing of individual transactions.