Is your investment strategy based on timing the market to invest when markets are low and get out when markets are high? Whilst this investment strategy certainly has its benefits there are some considerations you should be aware of. We have mapped out the state of mind of a hypothetical market timer below. Before adopting this strategy we encourage you to consider whether this approach is suitable for you.

Investors often make decisions based on emotions they have at the time and can then be disappointed when the results are not what they had hoped for. Chances are that we have all experienced some of the reactions portrayed in the chart below. Not only might you relate to this experience, but you may also be able to plot yourself at one of the stages shown.

This chart illustrates some of the psychological issues (problems) associated with a market timing investment strategy.

Deja Vu?

It can be tempting to switch investments or move to cash in uncertain times but market timing can be fraught with danger. This is due to the forward-looking nature of financial markets coupled with transaction costs and tax-related issues that can detract from your returns. There are risks associated with market timing and your portfolio can suffer if you get the timing wrong.

Market timing can be described as moving in and out of investments and/or asset classes by attempting to predict future market price movements. This often involves positioning a diversified portfolio away from its long-term strategic investment allocation for a short to medium term, in an attempt to add extra returns to the portfolio, by taking advantage of predicted better performing investments and / or by avoiding poor performing ones.

The following adage sums up the view; “it is not market timing that counts, but rather the amount of time that you are in the market”.

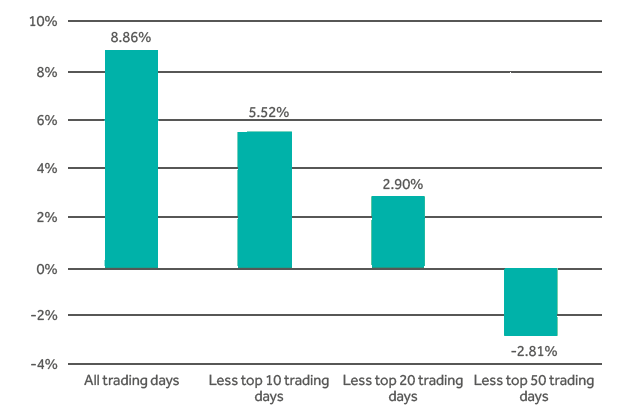

Being invested (and remaining invested) in the market is the key to long-term investment success. The temptation to “time” the market and deviate from your strategic asset allocation during volatile markets is strong; however, the opportunity cost can be great. The chart shows the impact that missing the best trading days of the Australian equities market (S&P/ASX 300 Accumulation Index) can have on investment returns. If an investor had been invested in the market for the full period (June 2004 to June 2019) the annualised return would have generated was 8.86%.

The above example illustrates that one of the biggest risks in attempting to time markets is potentially missing the markets best performing cycles.

Broad diversification across asset classes can be an effective way to guard against losses; not risky market timing based strategies. An investor needs to consider the risk of missing out on strong returns from markets as well as the combination of costs and taxes when attempting to time markets.

Investing in growth assets like Australian shares requires that along-term investment time horizon be adopted and investors need to accept that the value of their portfolio will fluctuate considerably over short periods of time.

Importantly, it is appropriate that investors identify their risk tolerance level and how this fits with their investment objectives or goals. In particular, you need to consider your risk tolerance or risk profile - this refers to your tolerance for market fluctuations and the trade-off between this and the desire to maximise returns.

The ultimate risk of course is the long-term opportunity cost associated with an overly conservative strategy, or one of inferior quality, or poorly implemented.

If you have any questions about your risk tolerance or current investment strategy please feel free to reach out to your Nexia Advisor for a complementary consultation.