We are happy to present our quarterly review of the mid-market IPOs on the ASX.

We are happy to present our quarterly review of the mid-market Initial Public Offerings (“IPOs”) on the Australian Securities Exchange (“ASX”). The focus of the analysis is on the current quarter and the immediately preceding 12 months with the aim of providing you with an overview of the current mid-market IPO activity.

In our analysis, we have looked at IPOs with an enterprise value of less than $200m at the time of listing. We have also provided some further detail on the cost of IPOs broken down by market capitalisation, and the performance of IPOs occurring in the last 12 months by significant sectors.

Key highlights are:

- There were 7 IPOs mid-market in the quarter, a decrease on last quarter and on the same period last year.

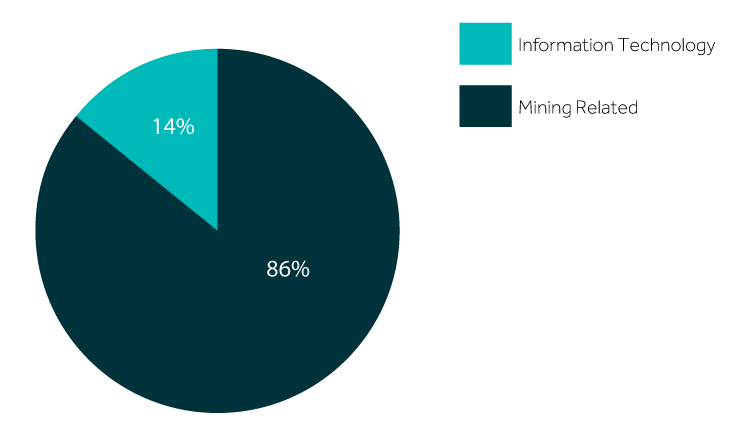

- The mining-related sectors were again the most active sectors in the quarter with 6 IPOs.

- Mid-market companies raised $72.7 million on the ASX in the quarter.

- The average IPO fundraising was $10.4 million, which is a 10.6% increase on the previous quarter, and a 5.1% increase on the 12-month average.

- On average, transaction costs (excluding brokerage fees) decreased by 12.2% to $0.2 million when compared to the prior year.

Overview

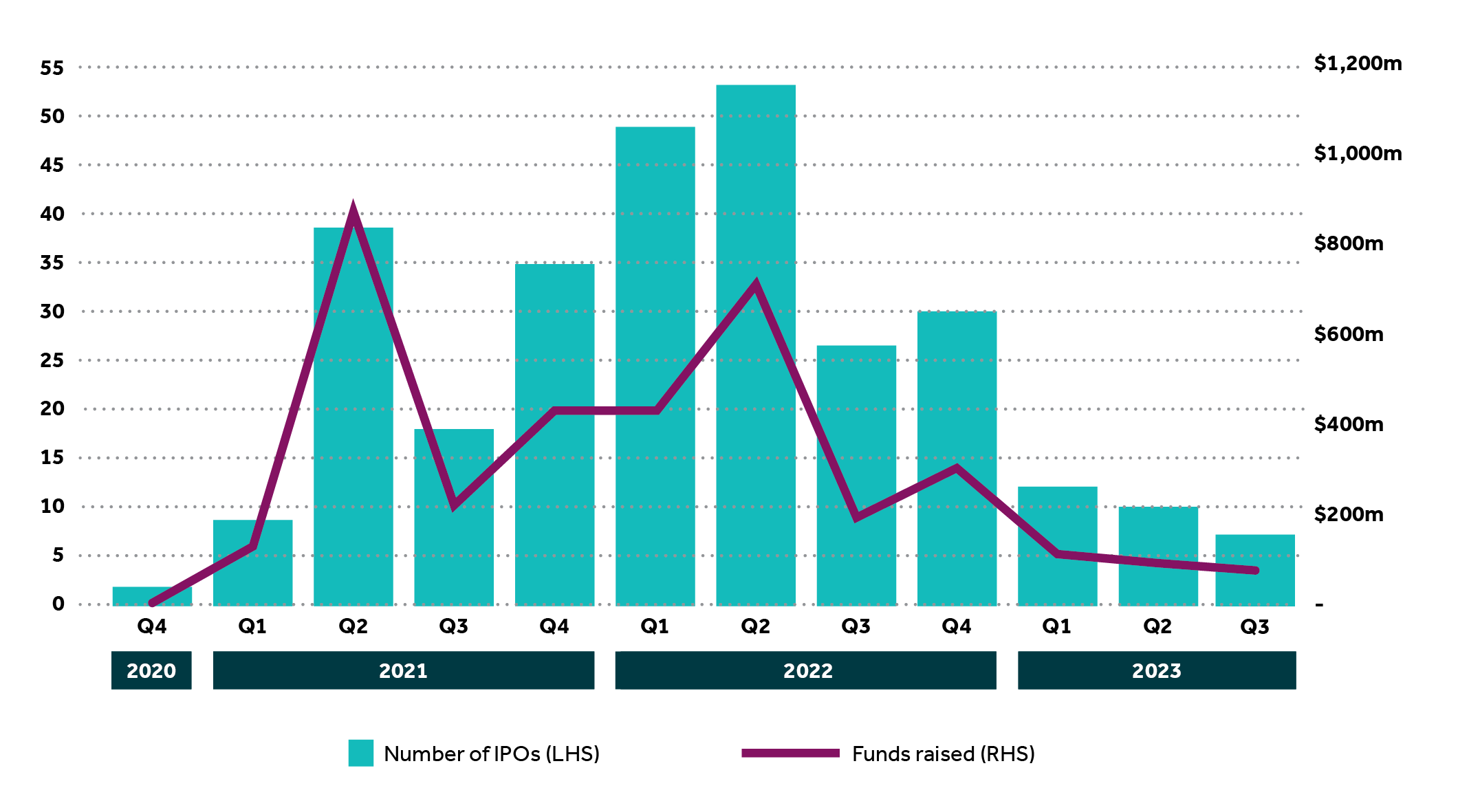

There were 7 IPOs in the mid-market this quarter, a 30.0% decrease from last quarter, but a 73.1% decrease compared to the same quarter last year (Q3 2022).

Total funds raised in the quarter was $72.7 million, a 22.3% decrease from last quarter, and a 64.2% decrease compared to the same quarter last year. The average funds raised per transaction this quarter was up by 11.0% from $9.4 million last quarter to $10.4 million, and a 33.1% increase compared to the same quarter last year.

This quarter has seen the 12-month average funds raised per transaction increase by 8.0%.

The average enterprise value at IPO in the quarter was $31.6 million, which was up 29.3% from last quarter and 23.6% from the same quarter last year.

Number of IPOs and funds raised by quarter

Quarterly Activity

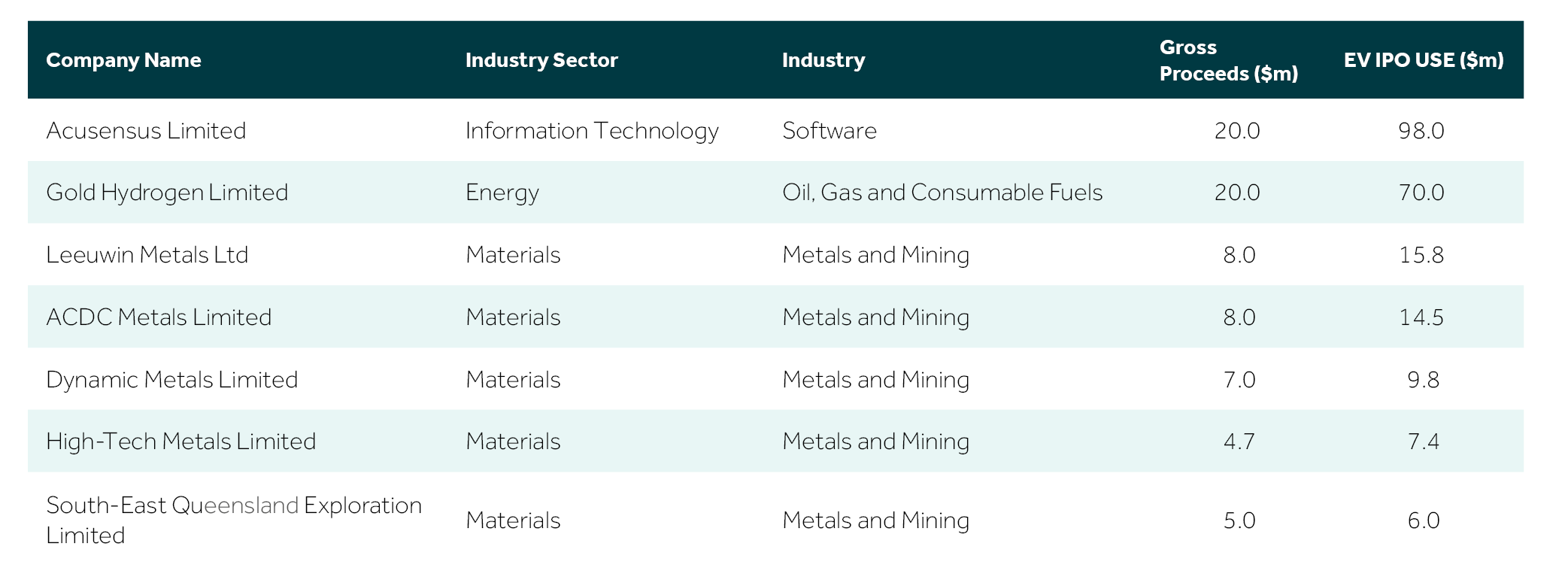

There were 6 IPOs within mining related sectors, followed by 1 IPO in the information technology sector. There were no IPOs in the health care, financials, consumer staples, consumer discretionary, utilities, real estate, industrials, and communications sectors.

Of the $72.7 million raised during the quarter, the materials sector recorded the highest value of funds raised at $32.7 million, followed by energy and information technology both raising $20.0 million.

The following funds were raised by sector in the quarter:

Sectors

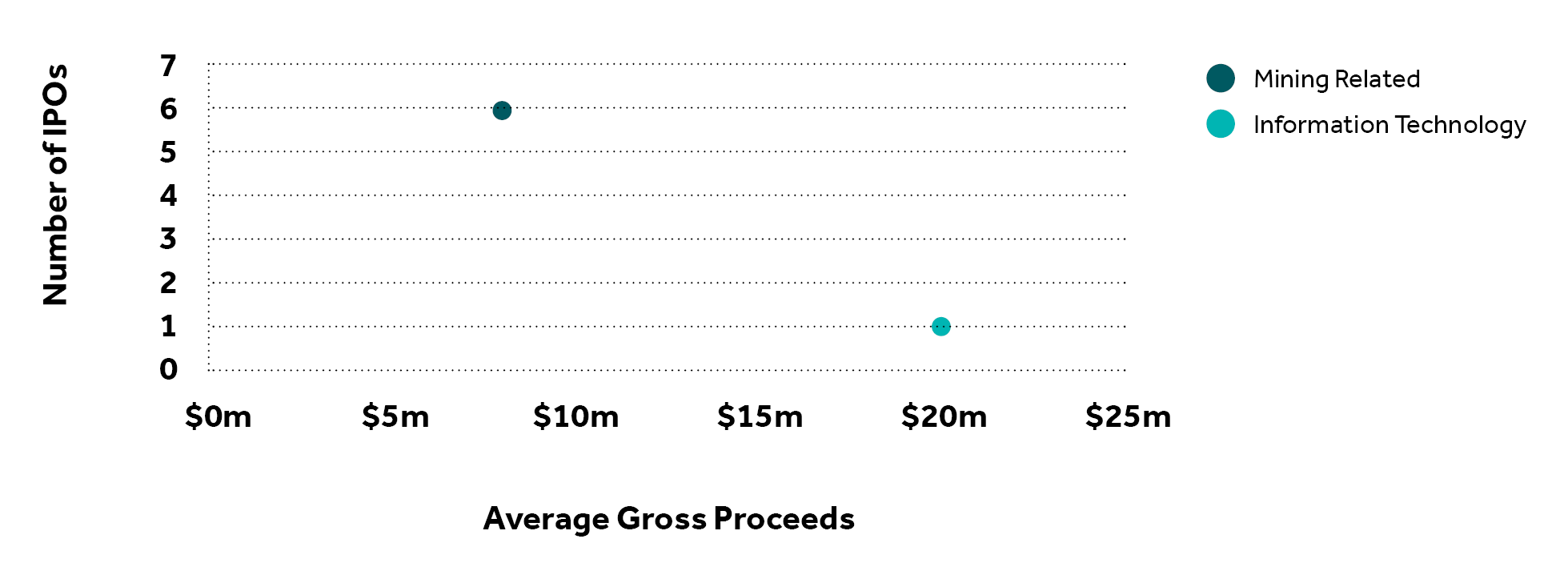

We have analysed the number of IPOs and average fund raising per sector over the last quarter to better understand sector activity.

Mining related sectors were the most active with 6 IPOs and an average funds raised of $8.8 million per transaction.

There was one IPO in the information technology sector this quarter, with gross proceeds of $20.0 million.

Number and average fundraising by sector (last 12 months)

Costs

Certain costs in undertaking an IPO, being accounting and legal costs, are typically fixed regardless of the outcome. Fundraising costs, on the other hand, are generally paid on successful completion of the IPO and represent a percentage of proceeds raised. Accordingly, fundraising costs have been excluded from our analysis.

A number of factors will impact the costs incurred, including how prepared the company is for the IPO, the complexity of its business and whether there are any related transactions. Average fixed costs per IPO were lower last twelve months compared to the previous year, falling from $220,531 to $193,575.

Methodology

This analysis has been prepared based on data sourced from S&P Capital IQ. Data analysed is for completed IPOs on the ASX, from 1 January 2023 to 31 March 2023, with an implied enterprise value of less than $200m. If no implied enterprise value was disclosed at the IPO filling date, transactions were adjusted to reflect the first enterprise value disclosed within the preceding 90 days.

Of the 7 transactions analysed for transaction costs there was sufficient data for 100% of the transactions to calculate the average accounting fees per transaction and there was sufficient data for 100% of the transactions to calculate the average legal fees per transaction.